montana sales tax rate change

The state sales tax rate in Montana MT is. The Call Center always does a good job helping when I call for assistance with my tax return.

How To Charge Sales Tax In The Us 2022

368 rows There are a total of 68 local tax jurisdictions across the state collecting an average.

. The minimum combined 2022 sales tax rate for Manhattan Montana is. Registration in Montana. Gianforte tax reform changes.

Tax rates are provided by Avalara and updated monthly. This is the total of state county and city sales tax rates. There are also additional fees that are added on top of the registration fee.

The December 2020 total local sales tax rate was also 0000. The Montana sales tax rate is currently. The state sales tax rate in Montana is 0 but you can.

You can learn more about licensing and distribution from the Alcoholic. The minimum combined 2022 sales tax rate for Clinton Montana is. Montana Sales Tax Ranges.

Montana currently has seven marginal tax rates. Free Unlimited Searches Try Now. This was the situation faced by a louisiana taxpayer.

The state sales tax rate in Montana is 0000. The bill will eliminate 23 tax credits. The registration fee in Montana is 8750.

Learn more about the Gov. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the. They are always kind and efficient.

Gianforte tax reform changes. The minimum combined 2022 sales tax rate for Roy Montana is. Department of Revenue Call Center.

The Montana sales tax rate is currently. Look up 2022 sales tax rates for Dixon Montana and surrounding areas. 2022 Montana Sales Tax Table.

Base state sales tax rate 0. Raised from 675 to 825. This is the total of state county and city sales tax rates.

The Montana Department of Revenue administers the states licensing distribution and taxation on Alcoholic Beverages. The current total local sales tax rate in Big Sky MT is 0000. The recent Montana tax reform package made several changes to individual and corporate taxes.

10 Montana Highway Patrol. The Montana use tax should be paid for items bought tax-free over the internet bought while traveling or transported into Montana from a. Montana currently has seven.

The local sales tax rate in Saltese Montana is 0 as of August 2022. There are no local taxes beyond the state rate. Combined Sales Tax Range.

Base State Sales Tax Rate. The Montana sales tax rate is currently. This reduction begins with the 2022 tax year.

Local Sales Tax Range. Ad Lookup MT Sales Tax Rates By Zip. The highest tax rate will decrease from 69 to 675 on any taxable income over 19800.

September 2022 Sales Tax Changes - 4 changes in 3 states. Gianforte signed another companion. I know they probably take.

The montana state sales tax rate is 0 and the average mt sales tax after local surtaxes is 0. This is the total of state county and city sales tax rates.

How Do State And Local Sales Taxes Work Tax Policy Center

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

State And Local Sales Tax Rates 2013 Map Income Tax Property Tax

Ci 121 Montana S Big Property Tax Initiative Explained

State Corporate Income Tax Rates And Brackets Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

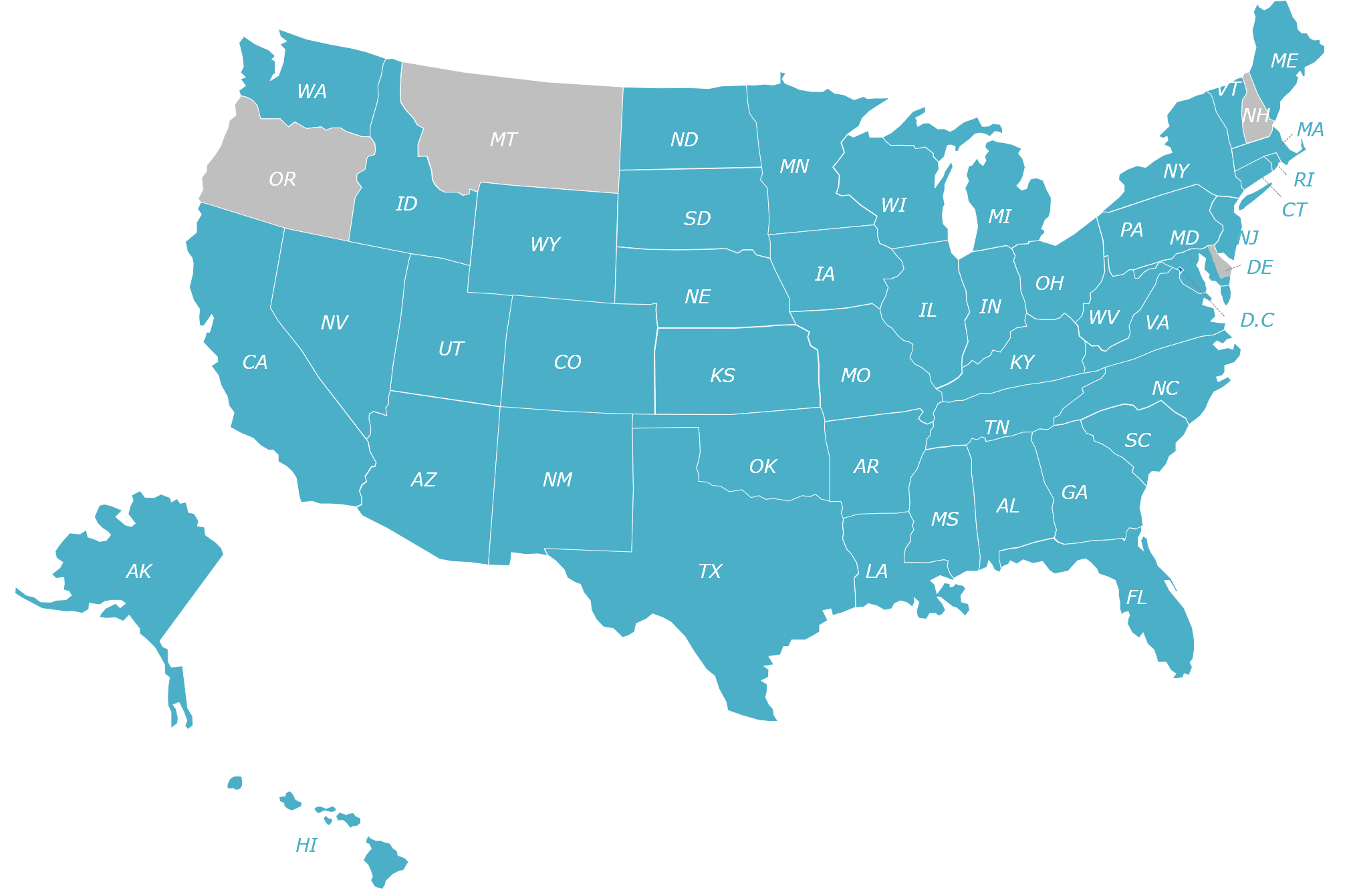

U S States With No Sales Tax Taxjar

Updated State And Local Option Sales Tax Tax Foundation

Montana State Taxes Tax Types In Montana Income Property Corporate

State Income Tax Rates Highest Lowest 2021 Changes

Taxes Fees Montana Department Of Revenue

Montana State Taxes Tax Types In Montana Income Property Corporate

Montana State Taxes Tax Types In Montana Income Property Corporate

Taxes Fees Montana Department Of Revenue

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes